DAI Leveraged Liquidity Pool DeFiZap Tutorial.

Learn how to add liquidity to Uniswap Pools while retaining 100% ETH Exposure.

NOTE: This Zap is currently on pause.

For those who have been keeping up with what we’ve been up to here at DeFiZap, we’re constantly looking for interesting opportunities in DeFi!

Our latest release of Unipool Zaps allows anyone to start earning trading fees by adding liquidity to Uniswap Pools using just one token (currently ETH but soon DAI as well).

DeFiZap auto-swaps ~1/2 of your ETH into entry ERC20 tokens required to match for the pool, effectively allowing you to start earning liquidity fees without having to go out of your way to supply both sides of the pool. This is extra useful to help Liquidity Providers measure their returns.

The demand for these Unipool Zaps has been phenomenal but there are two questions we are noticing users keep needing help with:

If ETH/USD goes up, do I lose the upside of that via contributing liquidity to these pools?

@zhusu @CryptoParent @antiprosynth @UniswapExchange @DeFi_Zap Nope you lose a percentage of the upside. If eth doubles in price you still get ~95% of that upside. If it tripples in value you get ~90% of that upside. And you get fees along the way.

@zhusu @CryptoParent @antiprosynth @UniswapExchange @DeFi_Zap Nope you lose a percentage of the upside. If eth doubles in price you still get ~95% of that upside. If it tripples in value you get ~90% of that upside. And you get fees along the way.If 1/2 of my ETH input is converted into entry ERC20 tokens (DAI, MKR, SNX, etc.) doesn’t this mean I will loose out on half of my profits if ETH price shoots up?

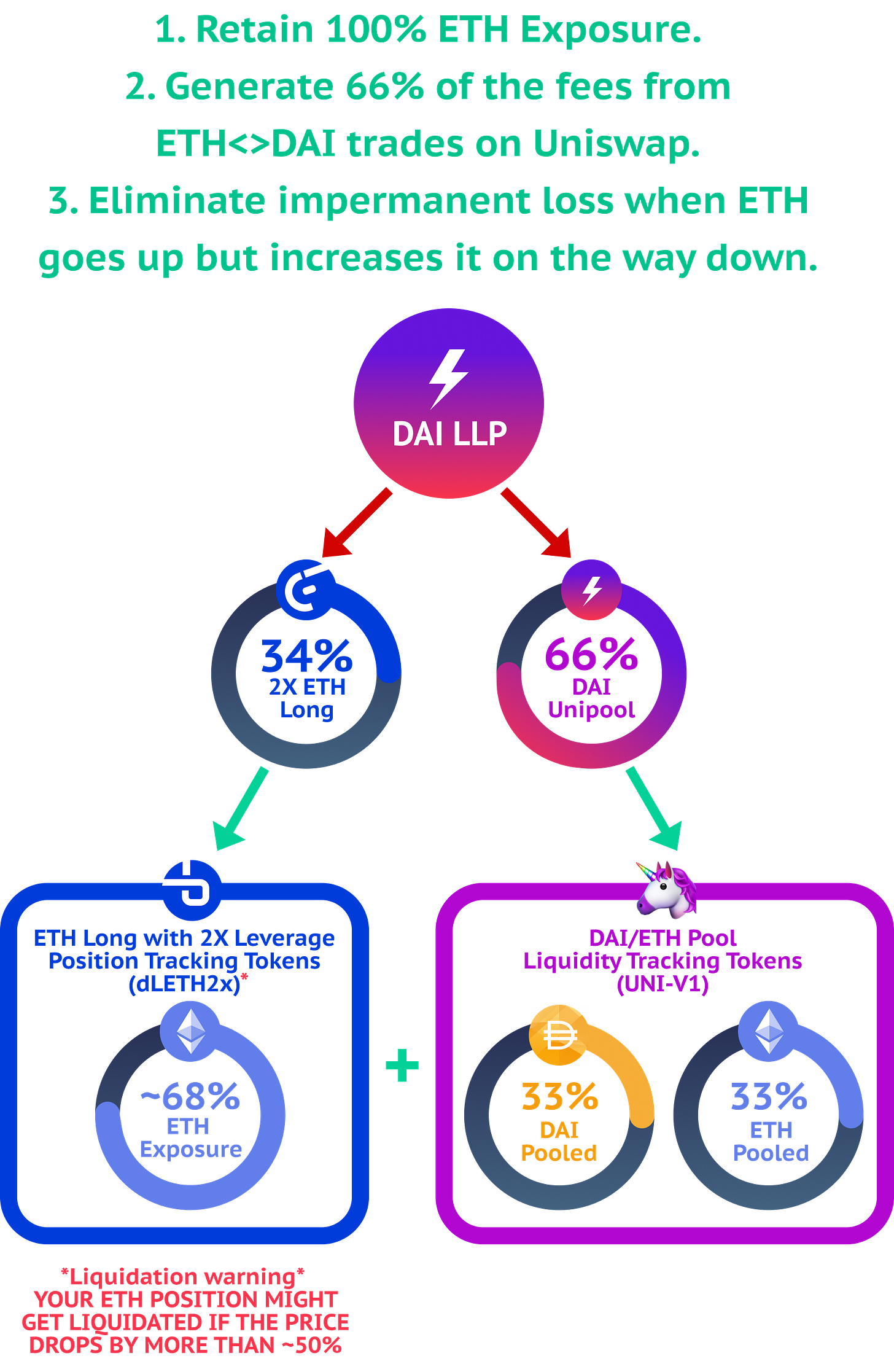

If you do not want to loose your ETH exposure while still being able to add liquidity to the DAI/ETH Pool, today we are launching a new Zap to help you do just that: DAI Leveraged Liquidity Pool.

So how does it work?

Visit https://defizap.com/zaps/llpdai and choose your ETH input amount. (DAI input coming soon.)

34% of your ETH input is used to open ETH Long position with 2X leverage on Fulcrum. For example, if you were to input 1 ETH, 0.34 would be used to buy ETH with 2x leverage giving you exposure to ~0.68 ETH.

66% of your ETH input is used to add liquidity through DAI Unipool Zap. For example, 1 ETH input would result in 0.66 ETH being allocated to adding liquidity to the DAI/ETH pool thus further splitting ~1/2 of 0.66 ETH into DAI. Bringing your ETH exposure down to ~0.33 ETH.

In the end:

Your ETH exposure remains ~100% (0.68 ETH + 0.33 ETH)

Eliminate impermanent loss on the way up while increasing loss on the way down while retaining 66% of Uniswap fees. So this Zap would be for someone who is bullish on ETH. (If you are bearish we are making a Zap which keeps your exposure 100% in DAI or other entry erc20s. And with Pool bridging you will be able to switch between pools in one click as your outlook changes.)

Here’s my transaction: https://etherscan.io/tx/0x0e6d538914a31ae20fbf4cad0f1092633f70a7bfd9b6a739945f469a5cb2a9b3

NOTE: Margin positions are subject to liquidations in case the price drops below the liquidation price. Please review your liquidation price + interest fees before using this Zap on https://fulcrum.trade/#/trade.

As of this writing, with Ethereum price ~$130, your liquidation price would be around $70.

Current interest rate you have to pay the amount you borrowed to place the margin trade (0.34 borrowed since we did 2X leverage) = ~6.4%

This means that if you are anticipating the price of ETH + generated pool fees to be greater than 6.4% interest expense, you should consider Leveraged Liquidity Pools.

Here’s an example of SAI/ETH pool returning annualized 23.88% in fees to liquidity providers. As you can see, your job is to decide which pools you think will generate most fees (aka have the most trading volume).

What happens after you use a Zap?

Visit https://uniswap.exchange/remove-liquidity to remove liquidity from Uniswap.

Visit https://fulcrum.trade/#/trade to manage your leverage positions.

We can’t wait to launch AntiZaps to help you 1 click withdraw/exit positions from multiple protocols in 1-click back to your preferred asset.

What’s next?

DAI Leveraged Liquidity Pool Zap is using 2x ETH long position to keep your ETH exposure. We will be launching support for additional pools.

Additionally, we are working on CDP LLPs which help you retain 100% ETH exposure by locking up part of your ETH input into a CDP and drawing DAI required for pool entry.

Note: when you use DeFiZap, you mint & receive the same liquidity/position tracking tokens as when separately using Uniswap, Compound, Maker, Synthetix, etc. on your own - just less time wasted.

DeFiZap doesn’t spread your ETH into 'top 10 on coinmarketcap' - Zaps inject ETH into financial protocols built on top of Ethereum, furthering user adoption.

⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️

Resources

⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️

QUESTIONS? JOIN US ON DISCORD or TELEGRAM.

⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️

Community love:

Cooper was the first one to visit my house and he wrote up a nice interview.

and more on our website DeFiZap.com

Recent Twitter love: