From 0 to 10 Billion: History of Zaps.

Introduction.

Two years ago Zaps made their DeFi debut @ Kyber’s Hackathon with one simple goal — abstract the complexities of accessing unique opportunities in open finance.

What’s a ‘Zap’?

A Zap is a smart contract that bundles multiple DeFi actions into a single transaction, enabling frictionless onboarding and saving time.

So far over 150 Zaps have deployed $10 billion across various DeFi protocols.

This post will review the History of Zaps; Where they came from, how they iterate, & current/future use-cases.

The Evolution of DeFi.

Today, Decentralized Finance (DeFi) is a multi-billion-dollar ecosystem of smart contracts, enabling a wide range of crypto-financial activities across multiple blockchains. DeFi’s open, permissionless, non-custodial, composable features have lowered the barrier for creating new financial instruments.

However, this Cambrian explosion of financial experiments would never have been possible without Ethereum’s community. They held true to the ethos of DeFi — build without compromising any of the four core principles.

“Skate to where the puck is going to be.”

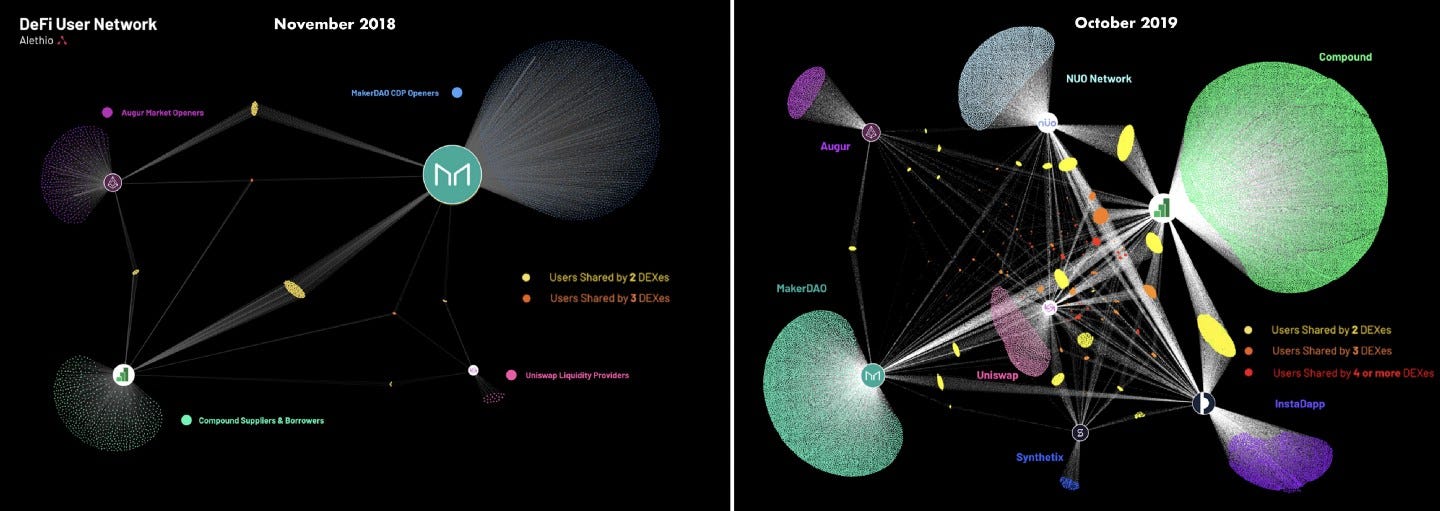

Looking at the 2018–2019 statistics, one might compare the total value locked and not see much progress. But even though the total value locked in DeFi year over year experienced only a modest increase, the number of users utilizing multiple DeFi protocols exploded.

In other words, only a small number of new users entered DeFi protocols that year. However those that did, not only stayed but they actively used more, especially as new protocols were introduced.

Why ‘Zaps’?

When I started to notice ‘DeFi’ popping up everywhere, I naturally gravitated toward it; given my background in accounting.

At the time, I didn’t know what to build. I started by making walk-through tutorials using new DeFi projects such as, MakerDAO, Compound & Uniswap, among others. Many of my legacy friends were intrigued but still hesitant to utilize these tools. That is when I decided to use DeFi Tutorials as a way to test drive & growth hack while simultaneously showing them that these products had real potential.

Interestingly enough, I actually parlayed my information from DeFi Tutorials to create something called DeFi Strategies. It was a trading simulator that used Google Sheets and Etherscan allowing people to mess around with DeFi using fake money.

After playing around with different scenarios, I noticed a number of users expected to be able to buy the bundle of their choosing directly within DeFi Strategies. I immediately connected this with a tool that connects thousands of Web-2 apps via Zaps called Zapier. It was clear that as more protocols launched onto market, DeFi would desperately need a tool comparable to Zapier - one that would connect DeFi actions performing an overarching task without having to visit each of the underlying Dapps individually.

The First Zap.

During Kyber’s DeFi hackathon, we only had one functioning Zap deployed on the mainnet: Lender Zap. This Zap simply allocated incoming deposits 90% to cDAI and 10% to opening a 2x leveraged ETH Long.

A key feature to note, is that Zaps don’t simply allocate your capital to ‘top 10 by market cap’, they deploy it directly into the underlying financial protocols. In other words, you mint & receive the same liquidity/position tracking tokens that you would if using Uniswap, Compound, Synthetix, etc, separately.

While Lender Zap cut out unnecessary transactions, it wasn’t just the ‘money allocator’ concept that won Kyber’s hackathon for us. It was a combination of the Zap Generator (survey that recommends which Zap combo might be right for you) and the integration of ENS capabilities, which allowed users to access DeFi opportunities simply by sending ETH to human-readable addresses directly from their Ethereum wallet.

Winning the hackathon gave us an incredible push from the community to keep building. The importance of improving UX in DeFi was clear.

Moving the needle for AMMs.

After deploying Lender Zap, we continued to gather user feedback to improve repetitive user transactions by bundling them. The flexibility to pivot by spinning up a new Zap in a short period of time, made Zaps the perfect tool for finding product market fit. Every Zap launch could be considered a mini product launch that focuses on a niche target market/user-case. You just need to listen, adjust and repeat.

From observing a common paint-point some users experienced while interacting with Uniswap Pools, we created Unipool Zaps. As many users are familiar at this point, you need to supply 2 equally proportioned assets if you want to enter a pool on Uniswap V1 or V2.

Here is a basic example:

Let’s say you are holding ETH; to add liquidity to the ETH/DAI pool:

Convert 1/2 of ETH into DAI,

Approve DAI for trading on Uniswap

Make a deposit of ETH + DAI to mint your LP tokens

DAI Unipool Zap bundles all of those steps into one; taking care of all the required conversions and allocations in the background so that anything you send to this contract will get converted 50% into DAI and 50% into ETH (if it’s already not in ETH) and deposited into the pool.

So instead of ETH → DAI → DAI Approval → DAI LP

It’s ETH → DAI LP directly.

Most Valuable Pegger.

The demand for Unipool Zaps was clear right away, especially around sETH/ETH pool. In addition to keeping your exposure fully in ETH, it rewarded stakers with SNX tokens.

This was the original Yield Farm. Prior to Anton’s infamous Liquidity Mining contract, which automated farming distributions; the Synthetics team was taking periodic snapshots of all sETH UNI-LPs and distributing SNX rewards manually.

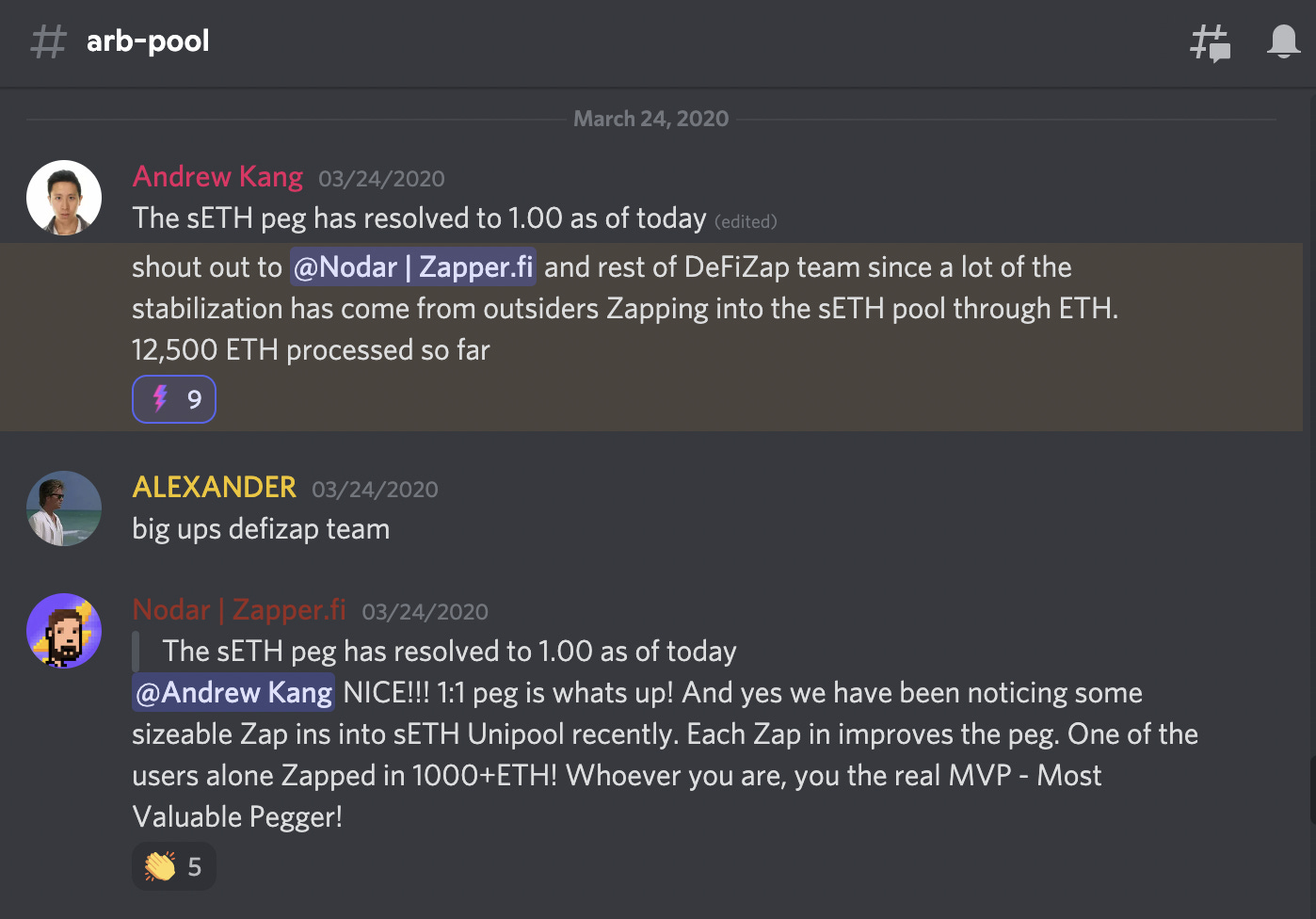

Every Zap into a sETH/ETH pool improved the sETH<>ETH peg itself, and by March the peg had resolved to ~1.00. It was a privilege working with the Synthetics community to improve liquidity around sETH.

But the majority of Uniswap pools didn’t keep your exposure fully in ETH. This was a big issue for those wanting to provide liquidity but anticipating ETH or ERC20 asset to increase in price much faster than the other one. To help eliminate impermanent loss, Leveraged Liquidity Pooling Zaps were introduced. These Zaps used ⅓ of your deposit to open a margin long position with 2X leverage on ETH or ERC20 asset (whichever you anticipate to go up faster in relation to the other). And the other ⅔ is deposited into your desired liquidity pool. Here’s an example of LINK Leveraged Liquidity Pooling Zap:

iEarn Zaps.

As DeFi got more complex, so did the number of possible Zap combinations. The best way to keep up with this demand is to open up the floor for builders to easily remix their own Zaps by combining existing Zap actions. This is why all Zaps were open-sourced from day 1 and it didn't take long for builders to start composing new financial instruments with Zaps.

Zaps 2 years later.

Continued user feedback & iteration ultimately lead to the inception of the robust ecosystem of over 150 Zaps you see today.