Margin trading on Fulcrum.

Hands on tutorial using bZx's first user-interface.

DISCLOSURE: IN LIGHT OF RECENT DISCOVERIES SURROUNDING BZX WE ARE NO LONGER USING FULCRUM FOR LEVERAGED TRADING AND ARE IN THE PROCESS OF ADDING ON ALTERNATIVE LEVERAGE TRADING PLATFORMS TO GIVE END-USERS AND BUILDERS OPTIONS TO CHOOSE WHICH PLATFORM THEY WANT TO UTILIZE WHILE ZAPPING.

AS ALWAYS: This is not investment advice. Please do your own research before investing. We are not affiliated, compensated or in any way associated with featured applications in our posts.

About DeFiZap.

DeFiZap uses smart contracts — Zaps — to deploy capital across multiple DeFi protocols in one transaction. Get instant access to DeFi directly from your Ethereum wallet. With lending, borrowing, staking, pooling, Leveraged Liquidity Pooling and more coming soon, DeFiZap is well-positioned to compose brand new use cases in finance.

Note: When using DeFiZap, users mint & receive the same liquidity/position tracking tokens as when separately using Uniswap, Compound, Maker, Synthetix, etc., on their own. With DeFiZap, you achieve the same end result just in less time and gas fees. Everything is routed through the supported protocols contracts, meaning there are no extra security risks added.

Rather than spreading capital across ‘ the top 10 tokens on coinmarketcap’ — DeFiZap injects capital into financial protocols built on top of Ethereum, furthering user adoption in #DeFi.

⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️

Interested in supercharging your wallet / UI with Zaps?

⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️

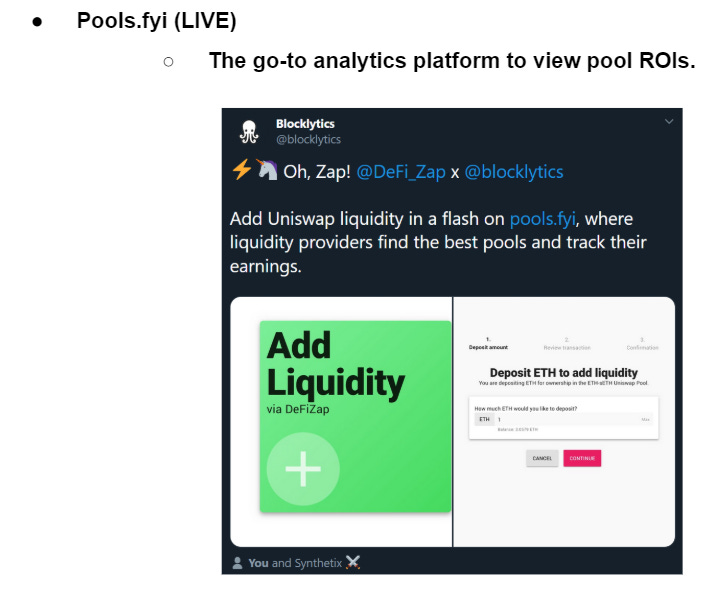

Integration examples:

iearn.finance

Robo-advisor aggregating not only lending but also pooling yields based on AMM.

Currently $5M+ locked in smart contract (AUM) which uses Zap in / Zap out to re-balance between pools.

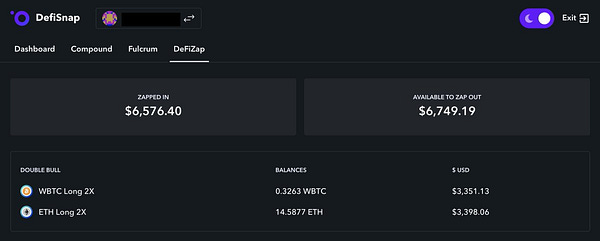

DeFiSnap.io

DeFiSnap.io (LIVE) SAMPLE USER BALANCE:

⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️

Recent community love:

QUESTIONS? JOIN US ON DISCORD or TELEGRAM.

⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️

Please note that DeFiZap is an experimental project. DeFiZap is not providing any investment advisory or recommendation service. By using DeFiZap or its services, you agree that you are using the Services at your own risk and that you will not and do not hold DeFiZap or its team members liable should the services not perform as per your expectation. DeFiZap is not a licensed financial advisor under any law. Please consult your own independent investment advisor before making any investment decisions.