The Ultimate Guide To Synthetix.

Learn about trading and minting Synths through this hands-on tutorial.

For this tutorial I teamed up with one of Synthetix’s power users @DegenSpartan.

What is Synthetix?

Synthetix is a decentralized synthetic asset exchange and issuance protocol built on Ethereum.

Synthetix Network (SNX) token holders lock up collateral in the platform to issue a wide array of synthetic assets, known as Synths.

The platform currently has forex currencies, cryptocurrencies, commodities and indices.

Being a Synthetix Trader

The Synthetix Exchange is a decentralized exchange for trading Synths.

Connect with either Metamask or your hardware wallet, and you’re in. No cumbersome registration, log-ins or KYC.

Once you are in, your available ETH and Synths will be displayed on the left. To trade on the Synthetix Exchange, you must have first have Synths and second have some ETH to pay for transactions.

If you do not have any Synths, you can buy sUSD with ETH. Select the amount of ETH you want to sell for sUSD, or the amount of sUSD you want to buy using ETH.

Alternatively, you can buy sETH+sBTC in a single transaction through Zapper.

Zap is a smart contract which bundles multiple transactions to help you achieve a well-defined goal. Typically DeFi users have to perform 3-4 transactions in order to achieve a desired DeFi action. For example: if you have ETH, to enter YFI Vault, you will first need to swap your ETH into YFI, after approve YFI, and finally supply YFI. Each one of these steps is a separate on-chain transaction, which you not only have to pay but also wait for to complete before you initiate your next one.

After you have acquired any Synth, you can use it to trade into other synths. In this example, I think that the price of ETH is going to go down, so I am selling sETH to buy sUSD.

A prompt will appear and after your transaction is confirmed on the blockchain, your trade is done!

*Available Synths:

Forex currencies (sUSD, sEUR, sJPY, sAUD, sGBP, sCHF)

Cryptocurrencies (sBTC, sETH, sBNB, sMKR, sTRX, sXTZ)

Inverse cryptocurrencies (iBTC, iETH, iBNB, iMKR, iTRX, iXTZ)

Commodities (sXAU, sXAG) *psst, gold and silver!

Indices (sCEX, iCEX) - a basket of CEX tokens and the inverse of it.

Points to note as a Synthetix Trader:

Synthetic assets are different from real assets in the sense that they are a price proxy of the asset which they are tracking. If you are a Synthetix MakerDAO (sMKR) holder, you would benefit from the price appreciation of MKR and the ease of exchange into other Synth, but your sMKR would not be recognized by the Maker Protocol to be eligible for voting or as payment for your Vault fees.

Being a Synthetix Minter

If you understand the exchange system, you must be asking yourself - “Where do the synths that I buy come from?”.

Mintr is the front-end interface for SNX holders to become minters and generate synthetic assets for the network, manage their staking and collect their share of fees.

Connect with a wallet.

Your screen will bring you to the Home screen that will display all your statistics.

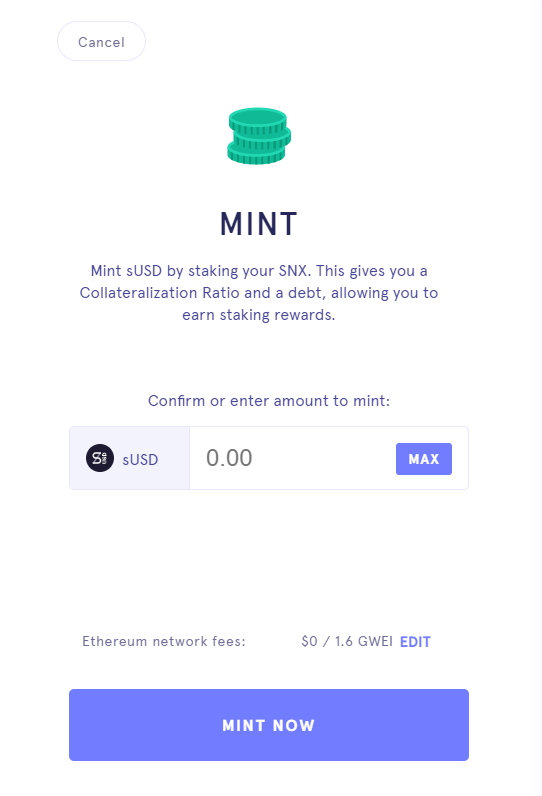

To start minting, click on “Mint” and decide how much you would like to mint. To be eligible for the maximum amount of fees and rewards, you would want to max out the amount that you can mint.

Once the transaction confirms, you should have sUSD in your wallet now. You can use this Synths as you wish, like as capital for trading on Synthetix Exchange.

Every Wednesday, a snapshot of all SNX minters will be taken and they will be awarded fees from the Synthetix Exchange fee pool, as well as SNX rewards. They can both we claimed in a single action.

*Do note that your current collateralization ratio must be very close to the target collateralization ratio, or else you will be locked out from claiming your fees and rewards.*

The burn screen will advise you how much sUSD you will need to burn to bring your collateralization back to the target ratio. If you do not have any sUSD, you will have to purchase sUSD to burn so that you can claim your rewards.

After 2 weeks, any unclaimed rewards will be forfeited and distributed to all the other SNX stakers.

Points to note as a Synthetix Minter:

The process of being a Minter can be quite confusing. Minters take on debt by issuing out Synths and depending on the performance of Synthetix traders, Minters can make profits or losses by staking in the system. A certain degree of understanding of the system and frequent activity to manage debt and claim rewards are necessary requirements to be a good Minter and support the network in a profitable way.

Additional learning resources:

Knowledge Base:

https://beta.mintr.synthetix.io/

https://www.synthetix.io/uploads/synthetix_litepaper.pdf

Once again special thank you to @DegenSpartan for this detailed walk-through!

Feel free to share with anyone who wants to learn more about Synthetix.

Disclosure: This is not investment advice. Please consult your own independent investment advisor before making any investment decisions.